The prolonged downturn in the broader cryptocurrency market ecosystem is triggering another round of widespread liquidations. According to CoinGlass data, the total liquidation amount in the market has exceeded $133 million in the past 24 hours, with the majority being long traders getting liquidated.

As expected, Bitcoin (BTC) leads the liquidations, with an overnight total liquidation value of $40.63 million. Among these liquidations, long traders accounted for $37.95 million, while short traders accounted for $2.69 million. Ethereum (ETH) ranks second with a total liquidation value of $12.14 million, making it the most liquid cryptocurrency. The liquidation figures are reasonable as both Bitcoin and Ethereum experienced a significant drop in price over the past 24 hours. BTC’s trading price of $29,185.25 represents a 1.91% decline, breaking through the crucial support level of $30,000, while Ethereum declined 0.84% to $1,854.29 during the same period.

Surprisingly, according to CoinGlass data, the newly launched WorldCoin (WLD) gained some support from major exchanges and recorded a modest liquidation of $4.45 million.

Throughout this year, “Today USA” has released a series of liquidation reports, and naturally, as the market conditions improve, liquidations tend to be cleared. Currently, the broader ecosystem seems to be distracted by the Twitter renaming to “X,” particularly concerning the future of cryptocurrencies like Dogecoin (DOGE). The cryptocurrency ecosystem has shown strong resilience in recent months, and the current setbacks may serve as another springboard for a new rebound.

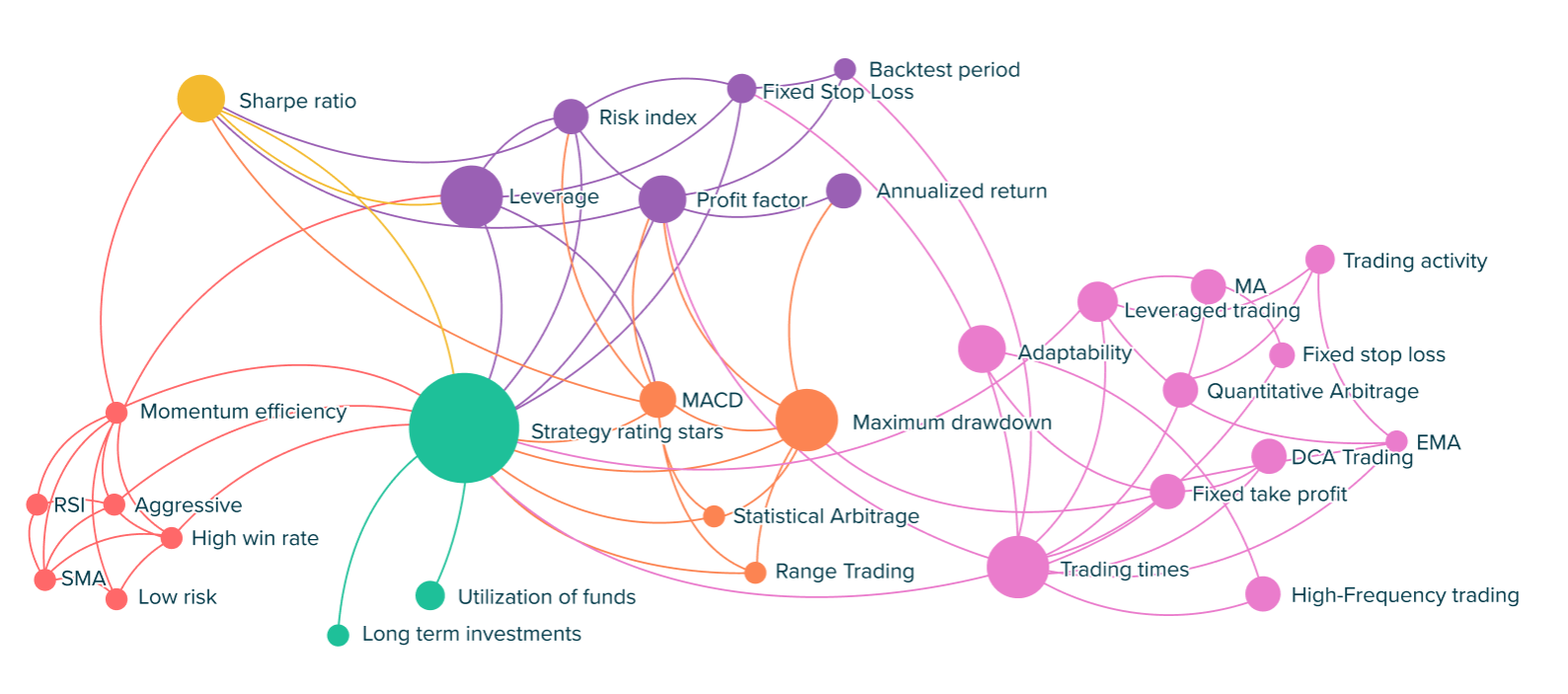

As you watch positions being liquidated every day, have you ever considered using a trading strategy that will never get liquidated? ATPBot provides strategies that are historically verified and have robust risk management. Take a look at the following strategy display, which has achieved significant returns over the past three years.