After experiencing the transition from the cryptocurrency bear market to the bull market in 2023, cryptocurrencies have once again become a focus of attention for investors. With the arrival of 2024, the SEC has finally approved multiple applications for Spot ETFs, injecting new vitality into the cryptocurrency market. In 2024, investors face an important question: in this rapidly evolving industry, how to choose the most suitable investment method? Should it be spot, futures, ETF, or something else? This article will analyze the characteristics of various investment methods one by one, helping you better plan your cryptocurrency investment in 2024.

What impact will the Spot ETF have?

The approval of the Bitcoin Spot ETF is of significant importance to the entire cryptocurrency market. This event signifies acceptance by mainstream finance, bringing more liquidity to the crypto market.

Looking at the market performance after the approval of the Bitcoin Spot ETF, the short-term trend reflects a favorable landing situation, with Bitcoin prices oscillating, and the market seems to respond to the news with an increase in trading volume, but the overall price change is not very pronounced.

However, the future after ETF approval seems promising. The short-term prices may not be fully reflected on the candlestick charts, but the increasing trading volume indicates a gradual rise in market attention.

In summary, the approval of the Bitcoin Spot ETF is a short-term positive development, with prices still in a fluctuating phase. However, from a long-term perspective, the crypto market will gradually move towards the mainstream stage.

Will 2024 be a bull market for Bitcoin?

Considering several factors, the conclusion that Bitcoin will enter a bull market is generally valid:

1.Inclusion of Spot ETF

This marks the transition of digital assets from niche to emerging asset classes. With BlackRock and other companies also applying for Ethereum Spot ETFs, ETH products are expected to receive industry attention in 2024. However, Bitcoin ETFs will be listed first within a year, bringing more funds from stock markets and institutions, contributing to increased liquidity and more participants. All these factors will assist in the upward movement of Bitcoin prices, becoming a significant catalyst for a bull market.

2.Bitcoin’s Fourth Halving

Expected on May 4th this year, Block 840,000 will reduce the mining reward from 6.25 bitcoins to 3.125 bitcoins, marking the fourth halving event in Bitcoin’s history. This is a crucial milestone for the protocol as its issuance undergoes exponential decay on the path to the eventual 21 million bitcoins.

Halving directly affects the interests of the entire mining industry chain, including mining equipment manufacturers, mining farms, miners, and leasing service providers. This consensus among these roles will likely impact market trends. Looking at the past three halving events, each has brought about a bull market lasting over a year.

3.Interest Rates and Bitcoin

Federal Reserve Chairman Powell has suggested that the Fed may have reached the peak of the interest rate cycle, which could potentially serve as a catalyst for Bitcoin’s rebound in 2024.

When interest rates stabilize or decrease, the attractiveness of cryptocurrencies like Bitcoin to investors increases. This is because Bitcoin is generally seen as a hedge against the traditional financial system, and its scarcity is continuously increasing, especially with the approaching halving in May.

4.Bitcoin’s Innovations

Positive developments are visible, with increased demand for block space on the Bitcoin network due to recent innovations such as the Ordinals protocol and BRC-20. Besides being recognized as a traditional store of value, the growing popularity of the Lightning Network (enabling faster transactions) could accelerate the broader adoption of Bitcoin for payments.

If Bitcoin continues to make progress in the payment sector and expands its applications, it can enhance its overall utility, contributing to reaching new price highs.

How should you invest in Bitcoin in 2024?

Although the probability of a bull market is very high, one cannot ignore the impact of other events, such as the White House proposing up to a 30% tax on U.S. Bitcoin miners due to environmental concerns. If Bitcoin continues to face criticism for its energy consumption, it may pose a threat to its price trend. In conclusion, 2024 is likely to be a period of fluctuating upward trends for Bitcoin. Now, combining common investment methods, let’s analyze the performance of each:

Bitcoin Spot

Spot investment is the most reliable way this year, as long as investors can withstand the pressure of downward fluctuations and hold steadily. The probability of eventual profit is very high, and the profit rate is likely to be above 50%. Experienced investors can try buying with a DCA (Dollar-Cost Averaging) strategy to further reduce the risk of short-term setbacks.

Futures & Contracts

With more institutions entering and more roles participating, this year’s market fluctuations are expected to be much more intense than the previous year. For futures and contracts, it will be a high-risk, high-reward year. Therefore, it is not recommended for novice investors to participate in futures investments, as the probability of losses will be high. Even for seasoned investors, it is advised to lower leverage, reduce positions, avoid liquidation, as events with daily fluctuations of 10% or more may occur every month.

Bitcoin ETF

ETFs are funds that directly hold Bitcoin, and their prices and volatility are closely related to the Bitcoin spot market. A Bitcoin Spot ETF allows investors to have direct exposure to the Bitcoin market without worrying about the security and custody issues of Bitcoin. ETFs are suitable for investors who cannot directly purchase Bitcoin due to legal reasons, allowing them to benefit from the growth in Bitcoin prices without increasing legal and tax risks. However, it is not a good choice for investors who can conveniently and without additional tax burden purchase Bitcoin. Therefore, investors should address legal issues in their region, invest an appropriate amount, and consider it as a supplement to traditional investments.

AI Trading Bots

AI trading bots emerged as a new investment method in 2023, similar to ChatGPT. AI trading bots use models for reasoning, making more accurate judgments about short-term and long-term market trends, attempting to optimize asset allocation. Ideally, AI trading bots can achieve returns close to futures at the risk level of spot.

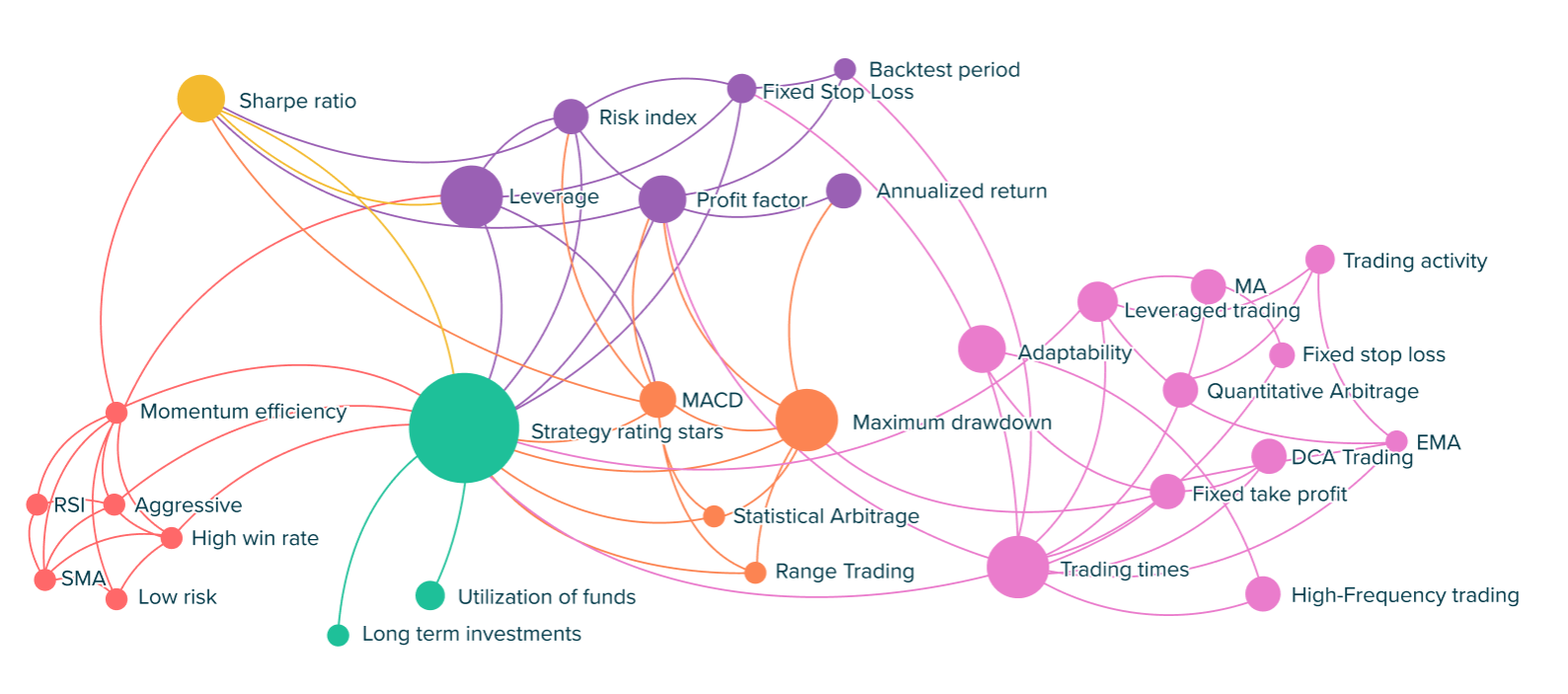

Currently, the most outstanding AI trading bot is ATPBot. ATPBot‘s AI trading bot can not only analyze real-time market data, grasp any profitable plan, but more impressively, it can assess risk levels in real-time, adjust futures leverage, providing investors with maximum security. Moreover, connecting ATPBot‘s AI engine to one’s exchange account completes the setup, eliminating concerns about fund loss.

Conclusion

The digital asset market will mature in 2024. The expected launch of Spot ETFs is an important milestone in Bitcoin’s relatively brief but impactful history. On this day 15 years ago, the Bitcoin genesis block was created, introducing a new concept of currency to the world. Now, Bitcoin has become the most prominent asset, bringing more profits to investors.