How would you typically react if your investment suddenly lost more than 10%?

A. Sell immediately to minimize further losses.

B. Do nothing and stick to a long-term investment strategy.

C. Buy more, seeing it as a ‘bargain’ opportunity.

D. Feel extremely anxious or depressed, unsure of what to do.

If you choose A or D, it generally means you are likely to be emotionally affected and are more prone to fall into the trap of emotional trading.

In the field of trading and investing, emotional traps are a common psychological hurdle that can have a negative impact on traders’ decisions and performance. Here are some common emotional traps:

- Greed

Greed makes people want more as soon as they see a bit of profit, often leading to over-investment or entering the market at inopportune times. - Fear

Fear usually appears when the market is unfavorable or asset prices are falling, prompting traders to sell off assets prematurely to avoid further losses. - Hope

When a trade isn’t going as expected, people often harbor unrealistic hopes, believing the market will turn around to meet their expectations. - Revenge Trading

This is an emotional response where traders, facing losses, will immediately execute another trade with the hope of ‘winning back’ their losses. - Overconfidence

Overconfidence can lead people to take unnecessary risks because they are too sure of their trading decisions. - Attribution Bias

Attributing success to one’s own abilities and blaming failure on external factors can impact the rational assessment of risks and opportunities. - Herd Mentality

It’s easy to be influenced by the crowd when many people are buying or selling, neglecting personal analysis and judgment. - Fear of Missing Out (FOMO)

This psychology drives people to follow the market when it is bullish, often buying high and ignoring potential risks.

To avoid emotional traps, traders need to establish and adhere to a clear trading plan that includes entry and exit strategies, risk management, etc., and try to eliminate emotional factors from the decision-making process.

Using tools like stop-loss orders or automating trading strategies can also be effective ways to control emotional trading. Some traders also engage in psychological training, meditation, or other methods to improve their emotional management skills.

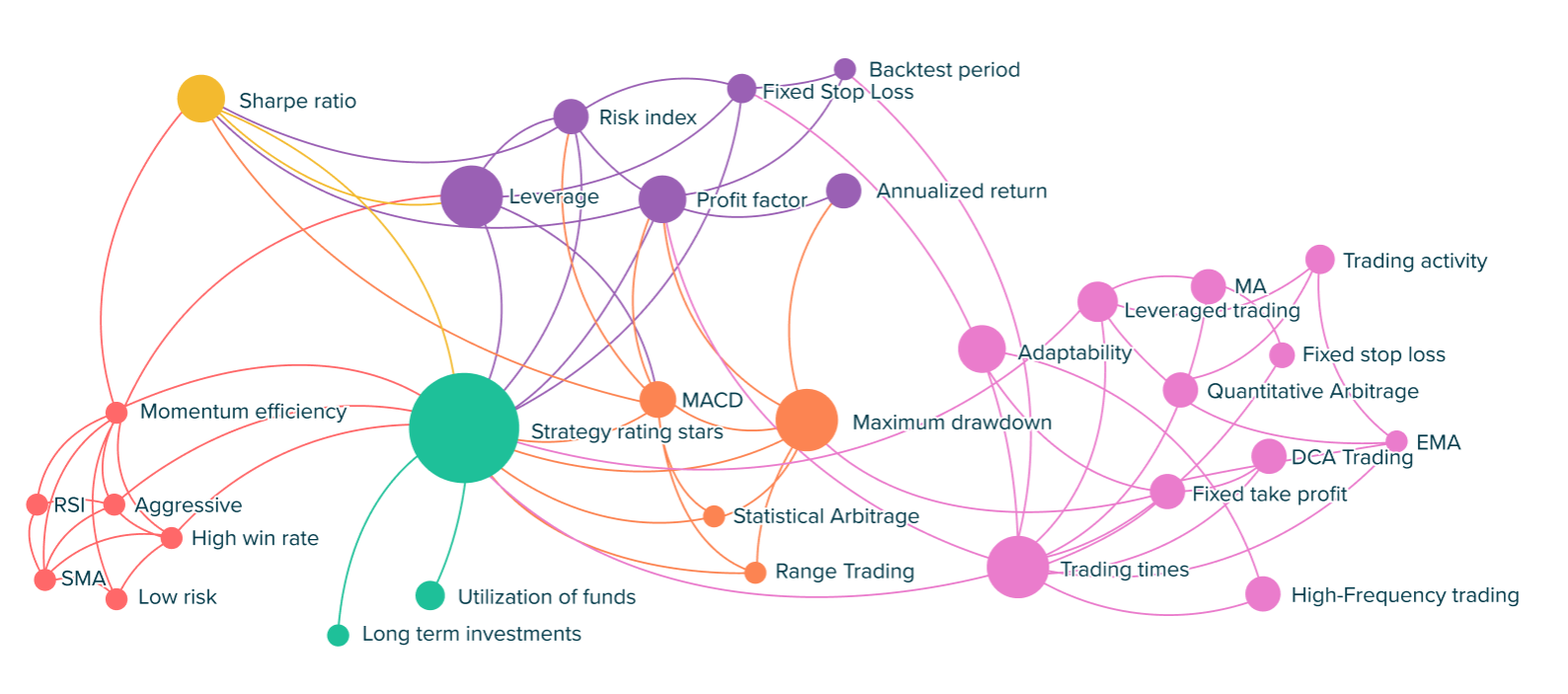

Compared to the methods mentioned above, the simplest approach is to use ATPBot.