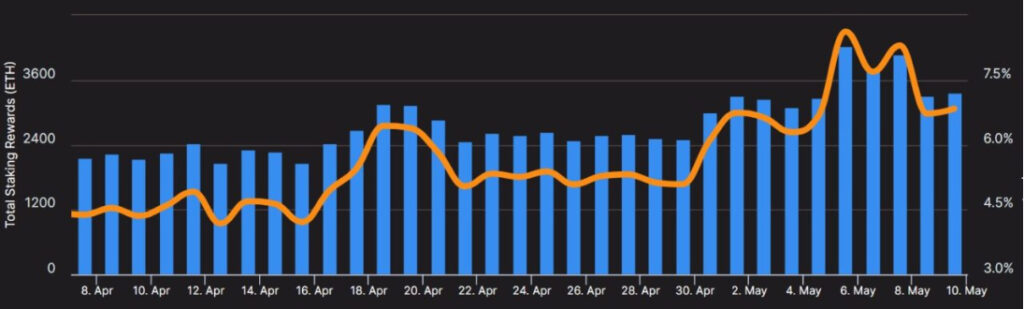

In the first week of May, Ethereum validators’ earnings surged to $46 million, largely due to an increase in staking returns. This figure is a 40% increase from the previous week’s earnings of $33 million, when $183,339 worth of ETH was allocated as rewards.

According to current data, over the past week, Ethereum network validators earned 24,997 Ether by helping secure the network through its Proof of Stake consensus algorithm.

This windfall is largely due to the frenzy of trading a new meme-themed digital currency called Pepe (PEPE). As reported by Cointelegraph, the rapid proliferation of this token has raised the average fees on the Ethereum network to over 100 gwei, the highest level since May last year.

As a result, end users now pay over $30 per transaction swap, leading validators to earn higher fee income from processing transactions and regular validator rewards.

Validators participating in the network consensus process need to stake at least 32 ETH, worth about $58,000 at the time of writing. It is possible to stake less than the required 32 ETH through services provided by centralized exchanges like Coinbase or Kraken, or liquidity staking solutions like Lido.

As reported by CryptoGlobe, Ethereum staking rewards hit a new record with an annual return rate of 8.6% earlier this month, largely due to a significant increase in on-chain gas fees driven by the ongoing memecoin trading trend.

PEPE, a popular meme coin inspired by the infamous meme and cartoon character Pepe the Frog, has entered the top 100 digital assets by market cap in less than a month.

In a recent high-risk speculative activity, despite the decline in the value of digital assets, three crypto whales have invested nearly $4 million in the meme-based cryptocurrency $PEPE.

Earlier, a lucky cryptocurrency investor seemed to have successfully turned a 0.125 ETH investment in PEPE into an astonishing $1.14 million by buying in at the right time, in just a few days.